How Medicare Supplement Can Boost Your Insurance Coverage Today

As people navigate the intricacies of health care plans and look for comprehensive defense, recognizing the subtleties of supplementary insurance becomes progressively essential. With a focus on linking the voids left by traditional Medicare strategies, these supplementary choices provide a customized method to conference particular demands.

The Essentials of Medicare Supplements

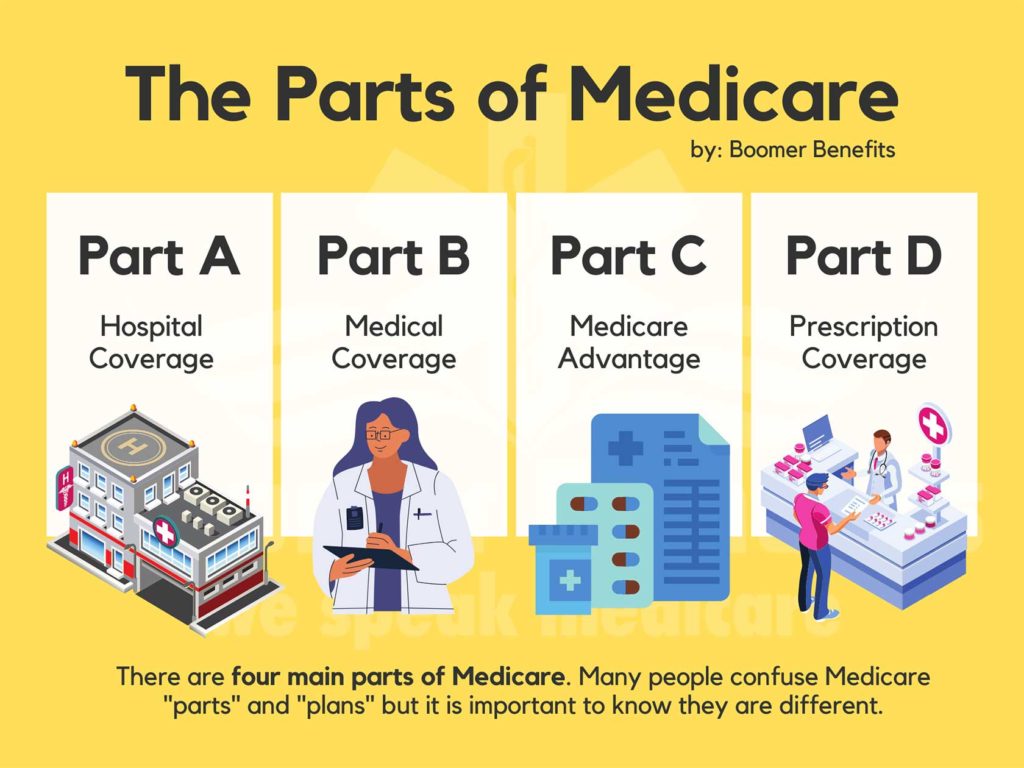

Medicare supplements, likewise recognized as Medigap plans, provide added insurance coverage to fill up the gaps left by original Medicare. These extra strategies are provided by exclusive insurance firms and are made to cover expenses such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Part A and Component B. It's important to note that Medigap plans can not be made use of as standalone plans but work together with initial Medicare.

One key element of Medicare supplements is that they are standardized across a lot of states, providing the very same basic benefits no matter the insurance coverage copyright. There are ten various Medigap strategies labeled A through N, each supplying a various degree of protection. For circumstances, Plan F is among one of the most detailed options, covering nearly all out-of-pocket costs, while various other plans may supply a lot more minimal insurance coverage at a reduced costs.

Comprehending the basics of Medicare supplements is critical for people approaching Medicare qualification who desire to enhance their insurance protection and decrease prospective economic concerns related to healthcare expenditures.

Recognizing Insurance Coverage Options

Discovering the varied array of protection alternatives readily available can provide important insights into supplementing health care costs properly. When thinking about Medicare Supplement plans, it is important to understand the different protection choices to make certain extensive insurance coverage security. Medicare Supplement prepares, likewise referred to as Medigap plans, are standardized across a lot of states and identified with letters from A to N, each offering varying levels of protection. These plans cover copayments, coinsurance, and deductibles that Original Medicare does not fully pay for, giving beneficiaries with monetary protection and tranquility of mind. Furthermore, some plans might use protection for services not consisted of in Initial Medicare, such as emergency treatment during foreign traveling. Understanding the insurance coverage options within each strategy type is essential for people to select a plan that lines up with their certain healthcare requirements and spending plan. By thoroughly assessing the insurance coverage choices readily available, recipients can make educated decisions to boost their insurance policy coverage and properly handle medical care prices.

Advantages of Supplemental Program

Comprehending the considerable advantages of extra plans can light up the value they bring to individuals seeking improved health care insurance coverage. One key advantage of extra strategies is the economic protection they provide by helping to cover out-of-pocket prices that original Medicare does not totally pay for, such as deductibles, copayments, and coinsurance. This can cause substantial cost savings for policyholders, especially those that call for constant medical solutions or treatments. Additionally, supplemental strategies supply a wider variety of coverage alternatives, consisting of accessibility to health care service providers that might decline Medicare job. This versatility can be essential for individuals who have certain medical care needs or like certain medical professionals or professionals. Another benefit of additional plans is the capability to travel with comfort, as some strategies use insurance coverage for emergency situation clinical solutions while abroad. Generally, the benefits of supplemental strategies add to a more detailed and customized technique to medical care coverage, making certain that individuals can receive the care they need without dealing with frustrating financial concerns.

Expense Considerations and Financial Savings

Provided the economic safety and security and wider insurance coverage choices given by additional plans, an essential element official site to think about is the cost factors to consider and prospective cost savings they supply. While Medicare Supplement prepares need a month-to-month costs along with the basic Medicare Component B premium, the advantages of reduced out-of-pocket prices commonly surpass the included cost. When reviewing the expense of extra plans, it is necessary to contrast costs, deductibles, copayments, and coinsurance throughout different plan types to determine the most cost-effective option based upon individual healthcare requirements.

By choosing a Medicare Supplement plan that covers a higher portion of medical care expenses, people can reduce unanticipated costs and budget plan a lot more properly for medical treatment. Eventually, spending in a Medicare Supplement plan can provide beneficial economic security and tranquility of mind for beneficiaries seeking detailed protection.

Making the Right Selection

With a variety of strategies available, it is essential to evaluate variables such as protection options, premiums, out-of-pocket costs, service provider networks, and overall value. Additionally, assessing your budget visit this site right here plan restraints and contrasting premium costs amongst various plans can help ensure that you select a plan that is cost effective in the lengthy term.

Conclusion